Green standards put india in the red

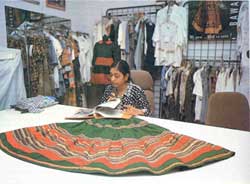

WHEN the US Consumer Product Safety Commission abruptly banned the sale of rayon chiffon ghagra-skirts from India in August this year, the Indian textile industry literally went up in flames. Indian exports of textiles to the US had been increasing happily over the past few years. But now the Americans were alleging that the chiffon skirts were dangerously inflammable and had ordered the recall of well over a quarter million of the vividly colourful garments already in the market.

WHEN the US Consumer Product Safety Commission abruptly banned the sale of rayon chiffon ghagra-skirts from India in August this year, the Indian textile industry literally went up in flames. Indian exports of textiles to the US had been increasing happily over the past few years. But now the Americans were alleging that the chiffon skirts were dangerously inflammable and had ordered the recall of well over a quarter million of the vividly colourful garments already in the market.

Immediately after announcing the ban, the US removed ghagra-skirts from the trade list of traditional handicraft and folklore items, which normally have unrestricted entry into the US market, to the fixed quota list meant for the regulated entry of non-handicraft textiles and garments. Although the US defended its decision as being in the interest of "national safety", some Indian exporters and officials suspected that the ban was a none too subtle measure to protect US domestic skirt manufacturers. Says a senior official from the Indian Union textile ministry, "The increasing popularity of ghagra-skirts in the US has pushed up their export by almost 30 per cent in past 2 years."

The episode is symptomatic of a trend towards "green protectionism", with international trade becoming increasingly vulnerable to regulations and practices that have less to do with green concerns than with keeping out of the red. Says M C Verma, an economist, "Environmental regulation may have the hidden agenda of acting as non trade barriers (NTB), even as other types of NTBs are being rapidly dismantled by the multilateral trading system."

Eco-benignity

Environment performance standards relating to products, processes and packaging are designed to ensure quality and environmental safety and entail substituting a large number of chemicals with benign stuff, process modifications, and pollution abatement measures. The International Finance Corporation estimates that the market for eco-benign goods and services will double to US$ 600 billion by the end of the century.

India's response to this changing trade pattern has been laggardly. The Union commerce ministry does not even have a clear strategy to influence the current debate on the possibility of trade-related environmental measures under the General Agreement on Tariffs and Trade (GATT). Its kneejerk reaction has been confined to an ad hoc awareness campaign. GATT, meanwhile, does not recognise process standards at all (see box: GATT ways). Only a few months ago, the commerce ministry had outlined the potential of green standards to unsettle industry in general. A missive was sent to the industries concerned -- chemicals, textiles, readymade garments, pharmaceuticals, food grains, fruits and leather -- informing them about the new product standards of the Organization for Economic Cooperation and Development (OECD) countries, which together account for 58 per cent of Indian exports and demand the strictest environmental standards.

The OECD countries are framing a series of environmental standards either in the form of regulations and directives or recommendations to regulate their imports (see box: Leather label). Packaging laws seek to minimise wastes (see box: Easy-to-dispose packaging). But, except a ban on benzedine, a textile chemical, and pentachlorophenol (PCP), a leather preservative, compliance in other cases is voluntary. Says A P Singha of the Indo-German Chambers of Commerce, "Governments in Germany, Sweden and the US are working on legislations on a wide range of standards. There are indications that 1995 could well be a deadline for their enforcement."

Green alert

In the wake of the eco-standards, a green alert has been sounded in key export sectors, particularly in textiles, which account for 34 per cent of India's exports. About 80 chemicals used in textile processing are destined to be phased out or be brought within prescribed limits, including pesticides used in cotton cultivation, heavy metals present in dyes and dye intermediates, and carcinogenic aromatic amines used for dye manufacture. "But this is only the beginning," says N Bhattacharya of the Bombay Textile Research Association. "Germany is investigating 8,000 chemicals for their harmful effects."

Besides textiles, leather products will also have to meet the eco-standards, seriously implicating chemicals, dyes and dye intermediate industries. "In a 'cradle-to-grave' approach, all these sectors are linked in one wide spectrum," says W B Achwal, a Bombay-based textile consultant to Swedish agencies working on eco-standards. "Adjustments will have to be made all the way down."

All this is beginning to tell on Indian exports. Residues of DDT have led to a steep drop in the country's sesame exports to the US and Japan. The US imported only 3,000 tonnes of sesame seeds in the past 2 years against 12,000 tonnes in 1989-90. Bhhasin of All India Rice Growers Association admits that they have had the same problem with the UK regarding rice exports.

However well meant the eco-standards may be, the cost of conforming to them will be killing, especially for the small scale sector, which accounts for 44 per cent of textile exports and over 90 per cent of leather exports. Says Ramu Deora, former chairperson of the Federation of Indian Export Organisations, "The access to alternative technology will be more curtailed."

But German experts from the General Development Institute think otherwise. They cited the Indian experience with PCP, the use of which in leather products was banned by Germany. The substitutes that the Indians used did not make an appreciable difference in their profits.

The truth is that the cascading effect of changing process standards on cost has not yet been fully assessed. There are only some estimates. Jyoti K Parikh of the Indira Gandhi Institute of Development Research, Bombay, estimates that investment on environment-friendly processes in leather range from 5 to 10 per cent of the cost of capital investment. The substitution of conventional chemicals would increase the cost 3 to 10 times. To this is added the cost of pollution abatement, which in Indian tanneries would increase cost price by about 1.5 per cent. Since India processes about 500,000 tonnes of skins and hides every year, the annual cost of treatment would be a decent Rs 50 crore.

But internalising environmental costs in product costs is dicey business, particularly since industry is unsure about the extent to which the importers will pay towards the cost of compliance. Some claim that the buyers are ready to pay 5-10 per cent more, but that may not be sufficient to cover the cost of technical adjustment.

No benefits

Says S Y Kamat, manager (business), Sandoz India Ltd, "The buyers are recovering excessive costs from their customers on green products but they are not passing on the benefit to us. Ultimately, our success in profiting would depend on effective bargaining." A case in point is that Japan, for instance, is ready to pay upto 250 per cent and the EC upto 25 per cent only for organically farmed foodgrains.

Bulk drug manufacturers in the small scale sector are particularly hard up. Says Ananth Thakore, president, Indian Drug Manufacturers' Association, "Today, bulk drugs are being promoted in the smallscale sector. But due to the controlled pricing of bulk drugs, manufacturers cannot even recover the cost of pollution abatement from their customers."

Meeting eco-standards may initially entail importing the eco-benign substitutes at a high cost. Says Ashok Jha, joint secretary in the Union commerce ministry, "There is just one local company which has commenced production of Busan 30, a substitute for PCP, largely imported from Germany."

Switchover troubles

Besides, there are problems with switching over. Dye substitutes, for instance, often do not compare well with the original products in shade, tone and depth of colour. When scientists in the Bombay-based Century Textiles and Industries Ltd realised that sodium or potassium dichromate, used as oxidising agents, release chromium in the effluent, they used hydrogen peroxide instead. But they have retained the use of dichromate while processing sulphur black and aniline black because hydrogen peroxide reduces the colour fastness. "Buyers will have to compromise on quality if they are insistent on green standards," says Kamat.

Also, suitable substitutes for chemicals such as the textile industry's formaldehyde may not be available in the country or may be too expensive. The largest producer of benzedine-based dyes in the country is Valsad-based Atul Products Ltd of the Lalbhai group. Benzedine-based dyes used to comprise about 30 per cent of their total dye production. Company spokespersons estimate that phasing them out in fits and starts has affected 25 per cent of their business. While the price of benzedine is Rs 85 per kg, the cost of its substitutes is Rs 170-275 per kg.

Even a large company like Atul has not been able to replace the whole range of benzedine dyes. While it claims that it has been able to develop 20 non-benzedine dyes in its laboratories, only 5-6 dyes are ready for commercial application. Fortunately, the company has been able to afford this additional investment, largely because it exports about 50 per cent of its annual dye production.

More R&D

How far can R&D bridge the gap in technical knowhow? The chemical industry is already lobbying for more incentives and support for R&D. Says Ashok Kadekia, chairperson of Bombay-based Ashok Organic Chemicals and president of chemical panel in the Chemical Export Promotion Council, "While in the past the R&D units had concentrated mainly on import substitution, priorities have changed now to export promotion."

The Indian industry's R&D expenditure is near rock bottom. Even United Phosphorous, a large chemicals manufacturer, spends only 0.32 per cent of its total turnover on R&D. Atul Products, on the other hand, claims that it spends about 4 per cent. In most cases, the proportion varies from 0.89-1.26 per cent.

On the brighter side, export-oriented mills have shown early signs of ecological wisdom and have installed more sophisticated production methods. For instance, Century Textiles and Industries Ltd, producers of pure cotton fabrics, exports about 85 per cent of its produce. Naturally, it has been more cautious about its housekeeping (see box: Thoroughbred textiles).

Some industrialists believe that even smallscale units can cope with the new trade environment. Says Satish Jhaveri, managing director of Chemisynth Ltd and president of the dyes panel in the Chemical Export Promotion Council, "If smallscale units like Pune-based Sudarshan chemicals and some others can get ISO 9002, it is not impossible for them to meet other product standards as well."

However, cumbersome procedures of complying with the standards, massive costs involved in getting the material tested for residues of banned chemicals, and the cost of obtaining certificates like the German Green Dot would probably be beyond the managerial and financial capability of smallscale units.

Meanwhile, a study conducted by the United Nations Conference on Trade and Development projects says that pressure on the developing countries to switch over to clean production methods will create a captive market for environmentally sound technologies (ESTs).

Says Veena Jha of UNCTAD, "In the OECD countries, the investment in EST was maximum during the '70s when they came up with comprehensive environmental legislation. But now that they have achieved economy of scale, they are looking towards other countries, especially Asia and East Europe, to corner the expanding demand for ESTs."

Jha says that the phasing out of PCPs implied that substitute chemical and tanning process largely available with a few firms in Germany would need to be imported by Indian leather producers. This builds up the prospects of technology transfer through direct foreign investment, joint ventures, or collaborations.

Indian efforts

In India, collaborations of the sharing-information-and-technology kind have seen more success. Even independent investigation by the partners into harmful chemicals are acted upon by the Indian counterparts. Says Ghoshal of ATIC, a collaboration between Atul and ICI, UK, "Our company, for instance, under recommendation from our partner, has phased out on its own Procion yellow M-4R dye as it was found to cause respiratory problems."

But, says Veena Jha, "The access of developing countries to ESTs may be constrained on account of high cost of obtaining them, and the laws on intellectual property rights." Confirming this, spokespersons from the agro-chemical industry say that Indian industry, when faced with a problem product, usually just stops producing it and scouts for other products. Says Gautum Dave of United Phosphorous, "We phased out pesticide based on mercury compounds when mercury was put on banned list and picked up other products." The new patent regime will make this flightiness difficult.

Predictably, multinationals have taken a lead in developing eco-friendly substitutes but they are also becoming extremely protective about their products. Says Kamat, "I now have chemicals to remove heavy metals from fabric. But we have stopped providing information. Others in the market are constantly duplicating MNC products." Abroad, Sandoz and Hoechst have developed several substitutes for formaldehydes and other chemicals, but the technology is not available in India.

One might have hoped that as a fallout of international pressure, even Indian consumer and environment would benefit from the green standards. On the contrary, the industry is distinctly segregating its produce for the domestic and the export markets. "Ultimately," says Kamat, "you will have to let the consumer decide. Purchasing power in India cannot support green products. Our modified products are targeted at the export market."

This, perhaps, explains why chemicals like benzedine that have been banned abroad are still being made in India. Moreover, even some European countries like Italy and Spain are still buying these dyes.

There is, as usual, a fly in the chemicals. Turning industry around to a safe-consumers point of view is always a protracted process, and Indian industry seems to be taking longer than the patience of the export market will allow. Meanwhile, says Kamat, "Everything is a matter of negotiation with other countries."

Related Content

- Affidavit filed by the Uttarakhand Pollution Control Board regarding non compliant STP in Uttarakhand, 12/04/2025

- Order of the National Green Tribunal regarding presence of heavy metals in Delhi air, 06/02/2025

- Order of the National Green Tribunal regarding elephant deaths in Bandhavgarh National Park attributed to Kodo poisoning, 10/01/2025

- Reply on behalf of the Automotive Research Association of India (ARAI) regarding presence of cancer causing chemicals in cars, 06/12/2024

- A comparison of the life-cycle greenhouse gas emissions from combustion and electric heavy-duty vehicles in India

- Order of the National Green Tribunal regarding Delhi STPs polluting Yamuna, 03/05/2024