The power of the zephyr

• Madras-based NEPC-Micon Ltd (a collaboration between Natural Energy Processing Co and Micon of Denmark), the largest suppliers of wind energy generators in India, expects to double its turnover of about Rs 153 crore in 1993-94 by mid-"95. NEPC-Micon has orders to supply 280 wind energy generators, valued at about Rs 280 crore, by March 1995 -- a long way from the modest turnover of Rs 20 crore in 1991-92.

• Madras-based NEPC-Micon Ltd (a collaboration between Natural Energy Processing Co and Micon of Denmark), the largest suppliers of wind energy generators in India, expects to double its turnover of about Rs 153 crore in 1993-94 by mid-"95. NEPC-Micon has orders to supply 280 wind energy generators, valued at about Rs 280 crore, by March 1995 -- a long way from the modest turnover of Rs 20 crore in 1991-92.

• Sun Source India Ltd of Gujarat has received state clearance for India"s first 100 mw wind farm project. The Rs 400-crore project is a joint venture between Sun Source and Cannon Energy Corp, a US-based wind energy giant which operates about 1,000 wind turbines in California.

• Classic Global Securities Ltd of Calcutta is setting up a Rs 10 crore, 2.5 mw wind power project at Kayathar, Tamil Nadu. Twentyfive per cent of the capital will be raised through a public issue, with financial institutions pitching in with the rest.

• Delhi-based Triveni Engineering Works Ltd signed a joint venture in October with US-based Zond Systems Inc for the supply of 500 kw wind turbines over the next 3 years. Triveni Zond Ltd will be entering the market in December 1994, with plans to develop wind farms in Karnataka, Andhra Pradesh, Tamil Nadu and Maharashtra. It has already acquired land in Karnataka to set up a wind farm.

• Reliance Industries is planning a Rs 350 crore venture to set up 100 mw wind farms in Gujarat. Larson & Toubro, the engineering and electrical giant, also plans to open their sails to trap the wind.

• Madras-based NEPC-Micon Ltd (a collaboration between Natural Energy Processing Co and Micon of Denmark), the largest suppliers of wind energy generators in India, expects to double its turnover of about Rs 153 crore in 1993-94 by mid-"95. NEPC-Micon has orders to supply 280 wind energy generators, valued at about Rs 280 crore, by March 1995 -- a long way from the modest turnover of Rs 20 crore in 1991-92.

• Sun Source India Ltd of Gujarat has received state clearance for India"s first 100 mw wind farm project. The Rs 400-crore project is a joint venture between Sun Source and Cannon Energy Corp, a US-based wind energy giant which operates about 1,000 wind turbines in California.

• Classic Global Securities Ltd of Calcutta is setting up a Rs 10 crore, 2.5 mw wind power project at Kayathar, Tamil Nadu. Twentyfive per cent of the capital will be raised through a public issue, with financial institutions pitching in with the rest.

• Delhi-based Triveni Engineering Works Ltd signed a joint venture in October with US-based Zond Systems Inc for the supply of 500 kw wind turbines over the next 3 years. Triveni Zond Ltd will be entering the market in December 1994, with plans to develop wind farms in Karnataka, Andhra Pradesh, Tamil Nadu and Maharashtra. It has already acquired land in Karnataka to set up a wind farm.

• Reliance Industries is planning a Rs 350 crore venture to set up 100 mw wind farms in Gujarat. Larson & Toubro, the engineering and electrical giant, also plans to open their sails to trap the wind.

A VIRTUAL blizzard is blowing across the wind energy sector in India, with collaborations and investments galore and the Union ministry of non-conventional energy sources (MNES) working overtime to clear projects and dangle inviting financial carrots. The past few months have witnessed a gush of new investments worth at least Rs 100 crore, with wind farms to be set up mostly in Tamil Nadu, Gujarat and Maharashtra.

India"s installed capacity to generate electricity from wind increased by about 80 per cent from January to November this year -- from less than 100 mw to 180 mw. It could soar to an astounding 250 mw by March 1995, a tiny fraction of the estimated potential of over 20,000 mw. Although infinitesimal compared to India"s conventional power capacity of about 75,000 mw, this fast-growing renewable energy source could rush India towards global leadership not just in wind energy but in the overall renewable energy scenario.

Flush with credit lines to the tune of about US$ 78 million from the World Bank and the Global Environment Fund, with promise of more to come, the Indian Renewable Energy Development Agency (IREDA) -- the financing arm of the MNES -- claimed that at one shot it cleared 9 proposals for wind energy projects worth over Rs 10 crore in the 3rd week of November. In Tamil Nadu alone, as many as 458 entrepreneurs are eager to produce more than 110 mw of windpower.

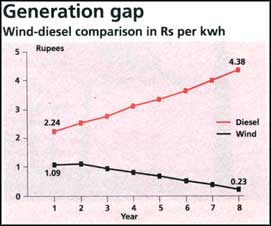

The major allure of wind energy power lies in its cost, or lack of it. According to the MNES, the investment required to generate 1 mw is Rs 3.5 to 4 crore, while generation costs range between Rs 2.25 to 2.75 per kilowatt hour. This compares favourably with the Rs 2 crore required to generate 1 mw of conventional energy, without taking environmental costs into consideration. With some new ventures like the Enron project, the generating cost is as high as Rs 4.5 crore per mw. And with wind energy, the raw material comes free. Wind farm projects also have an enviable gestation period of less than 1 year and a useful life of 20 years.

Winds of optimism

Exults S Krishna Kumar, minister of state at the MNES, "India is poised to become the 2nd largest wind energy producer in the world in the next 3 years." Early in 1993, the MNES revised the target for power generation from 200 mw to 500 mw by 1997. International wind energy leaders like the Cannon Energy Corp and Zond Systems Inc of the US have already spawned Indian ventures. Danish wind energy giants like Micon, Vestas and Nordex are deep in discussion with their Indian counterparts. Leading Indian engineering industries like Reliance Industries and Larson & Toubro are also set to jump into the wind wagon with their huge surpluses.

Banks, financing companies and consulting firms are finding it hard to keep pace with enquiries from eager investors. Parag Shah, director of Shaswat Consultants Pvt Ltd of Bombay, says, "Because of the huge tax benefits, large and small companies want to invest in wind energy. We see a tremendous business potential in this sector."

Wary of being left behind in the slipstream, the public sector giant, Bharat Heavy Electricals Ltd (BHEL), the first to enter the market with 55 kw wind turbines in 1989, has signed a technical collaboration with Nordex of Denmark for the supply of 250 kw wind energy generators (WEGs). It is also installing a 1.5 mw wind farm for the Maharashtra Energy Development Agency. Altogether, BHEL will install 50 units in Gujarat, Maharashtra and Andhra Pradesh by 1997. Says S K Gupta, general manager (regional operations), "BHEL is aiming to achieve a 30 per cent market share by the turn of the century."

Behind this surge lies the impetus provided by the MNES. Claims Krishna Kumar, "The satisfactory performance of the demonstration wind farm projects, as well as our new policies, have provided a major impetus to private sector participation." Initially, there were no takers from the corporate sector. Things changed when the MNES accepted an offer from the Danish International Development Agency (DANIDA) to set up wind farms in Gujarat and Tamil Nadu with a total capacity of 20 mw. Says Vinay Kapila, trade councillor in the Danish Embassy, "DANIDA"s role has been purely catalytic. The Indian private sector spurred the programme on."

| Air power | |||

| Wind power in India in mw | |||

| State | potential | December " 93 | November " 94 (estimated) |

| Tamil Nadu | 5,000 | 40 | 120 |

| Gujarat | 5,000 | 26 | 35 |

| Madhya Pradesh | 2,000 | 0.5 | 2 |

| Karnataka | 2,000 | 0.5 | 2 |

| Andhra Pradesh | 1,500 | 0.5 | 4 |

| Kerala | 1,000 | 0 | 4 |

| Maharastra | 1,000 | 1.5 | 6 |

| Others | 2,500 | 2.0 | 7 |

| Total | 20,000 | 71 | 180 |

According to L M Menezes, secretary, MNES, "By and large, the wind energy programme is driven by the private sector, with the ministry creating the right conditions." About 80 per cent of the present installed capacity is in the private sector. "Projects of almost 1,000 mw of installed capacity are in the pipeline," adds Menezes.

Wheel and bank

The entry of private investors received a further fillip because the MNES persuaded the state governments and state electricity boards (SEBs) to introduce a system of "wheeling and banking" of power, where the generating firm can feed power to the grid and draw it at a different location or at a later date, according to demand. Tamil Nadu and Gujarat were the first states to initiate this. The SEBs have also begun to concede a viable price to windpower generating companies. Says Ajit Gupta, director (power group) in the MNES, "We are trying to get the states to agree to a uniform price of Rs 2.25 per kilowatt hour."

The government has also pitched in with fiscal incentives, which include a 100 per cent depreciation on capital investment in the first year of operation. Wind energy conversion systems can further avail of accelerated depreciation and are exempt from sales tax and excise duty.

The SEBs in different states have offered other concessions. Gujarat has allowed a 50 per cent exemption on sales tax for investments made in wind farms. As land availability and litigation in certain cases were a hurdle, the Gujarat Energy Development Agency now buys the land and leases it out to developers. The state also offers sales tax exemption and capital subsidy for windpower equipment.

The MNES has made a significant contribution in identifying the sites and estimating potential. It has carried out a comprehensive programme of wind resources assessment in all the 23 states of the country and has brought out a wind atlas with the help of its many windmapping and monitoring stations. The ministry is also supporting the state agencies to prepare master plans for the development of known windy regions.

Many of the newer entrants are coming up with promises of better technologies and higher capacity machines. From the initial wind turbine capacity of 55 kw, unit sizes have jumped to 250 kw. Capacities of 400 to 600 kw are also in the offing. Says V Krishnamurthi, general manager of NEPC-Micon, "The first 400 kw WEG was commissioned by us at Muppandal in September 1994, the first of its kind in Asia. Three more were installed subsequently. The first 600 kw WEG is to be set up by March 1995."

According to Rakesh Bakshi, managing director of Vestas RRB India Ltd of Delhi, "Two types of wind electric generators have been installed in India -- the pitch regulated and the stall regulated. These, however, have capacities upto 200 kw. But now Vestas is offering pitch regulated WEGs of even 500 kw." These machines, experts claim, would enhance optimum utilisation of the machine while stretching longevity.

BHEL claims that it is miles ahead of others in indigenisation. Says K Ramakrishnan, director (engineering and R&D), "Unlike the imported machines of our competitors, we have indigenised almost all the components. It is only the blades that are still being imported." The company has developed its own induction generator and microprocessor based controllers for 55 and 200 kw units at its Hyderabad-based R&D centre.

The wind energy scenario is, therefore, set for a fast sail ahead. It is now just a matter of holding on to a direct course towards sustainable energy.